Syngenta has established different Programs / Facilities in order to adequately cover the Group's long-term funding requirements as well as the expected fluctuations in working capital.

Debt Capital Market programs

- USD 2'500'000'000 Global Commercial Paper Program

- European Medium Term Notes (EMTN) Program

- Base Prospectus dated March 21, 2014 and listed at the Luxembourg Stock Exchange

- Base Prospectus dated April 6, 2018 and listed at the Luxembourg Stock Exchange

- Base Prospectus dated March 16, 2020 and listed at the Luxembourg Stock Exchange

- First Supplement to the Base Prospectus dated September 18, 2020

- Second Supplement to the Base Prospectus dated November 20, 2020

- Final Terms dated April 14, 2020 of the € 500 million 3.375% Eurobond due April 2026

- Final Terms dated April 22, 2020 of the € 100 million tap of the €500 million 3.375% Eurobond due April 2026

- Final Terms dated October 15, 2020 of the € 200 million tap of the €600 million 3.375% Eurobond due April 2026

- Final Terms dated November 25, 2020 of the € 100 million tap of the €800 million 3.375% Eurobond due April 2026

- Base Prospectus dated April 26, 2021, listed at the Luxembourg Stock Exchange

- Base Prospectus dated May 10, 2022, listed at the Luxembourg Stock Exchange

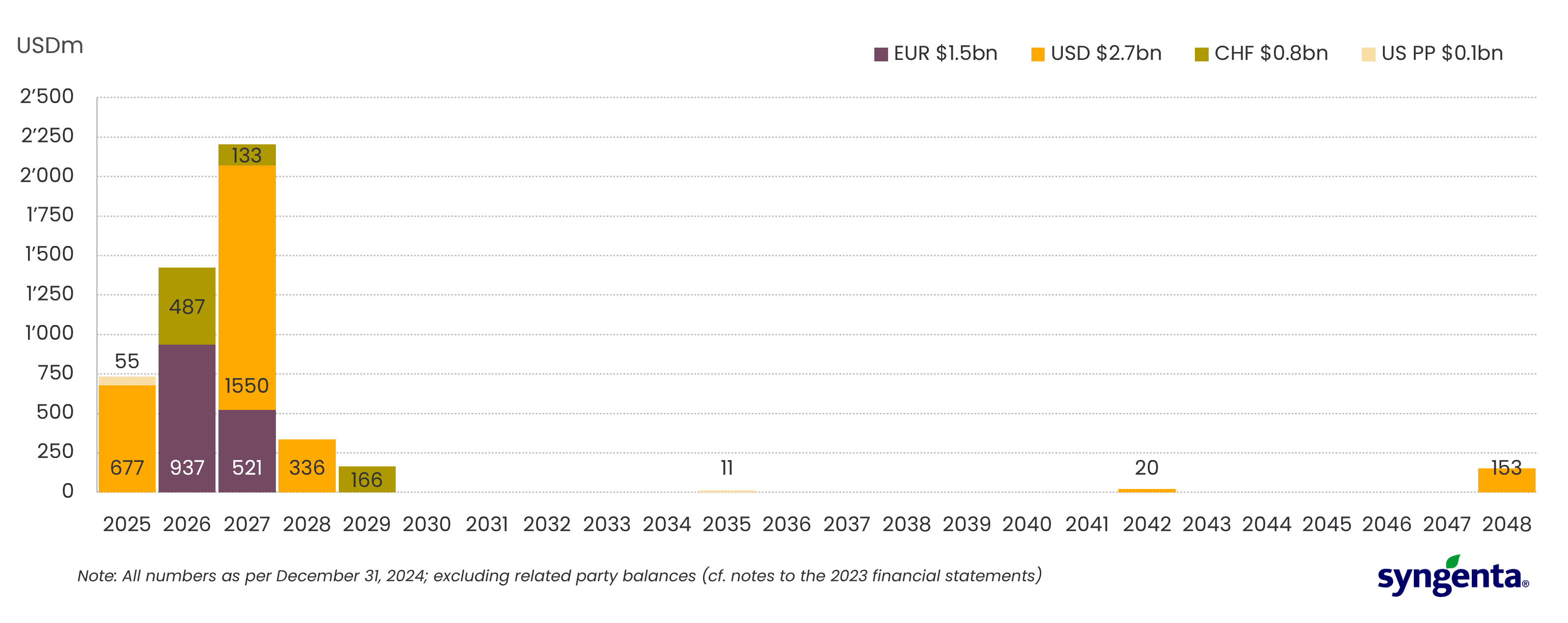

Long-term debt instruments outstanding

| Instrument | Size | Coupon | Maturity | Documentation |

|---|---|---|---|---|

| US$ 144A/RegS Notes | US$ 677m | 4.892% | Apr 2025 | 144A/RegS |

| Private Placement Notes | US$ 55m | 5.35% | Dec 2025 | Note Purchase Agreement |

| Term Loan | CHF 300m | n/a | Feb 2026 | Term Loan Agreement |

| Eurobond | € 900m | 3.375% | Apr 2026 | EMTN |

| Swiss Domestic Bond | CHF 140m | 0.700% | Dec 2026 | Standalone |

| Term Loan | US$ 1,000m | n/a | Jun 2027 | Term Loan Agreement |

| Eurobond | € 500m | 1.25% | Sept 2027 | EMTN |

| Term Loan | US$ 550m | n/a | Oct 2027 | Term Loan Agreement |

| Swiss Domestic Bond | CHF 120m | 1.50% | Nov 2027 | Standalone |

| US$ 144A/RegS Notes | US$ 336m | 5.182% | Apr 2028 | 144A/RegS |

| Swiss Domestic Bond | CHF 150m | 2.125% | Nov 2029 | EMTN |

| Private Placement Notes | US$ 11m | 5.59% | Dec 2035 | Note Purchase Agreement |

| US$ Notes | US$ 20m | 4.375% | Mar 2042 | US Shelf |

| US$ 144A/RegS Notes | US$ 153m | 5.676% | Apr 2048 | 144A/RegS |

Excluding related party balances (cf. notes to the 2023 financial statements)

Current long-term debt maturity profile

Image